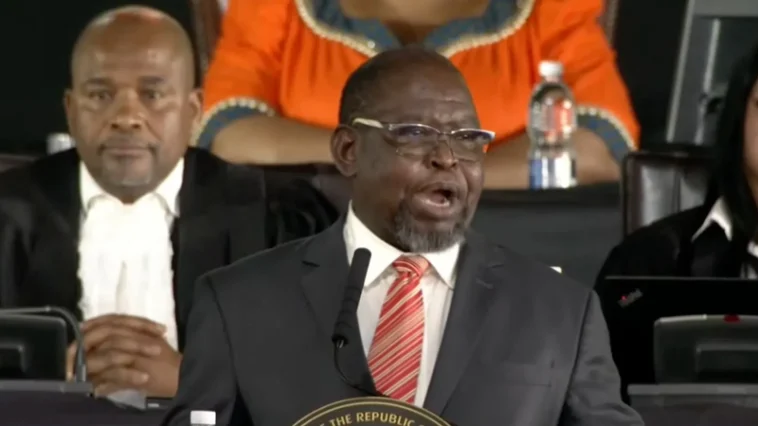

Finance Minister Enoch Godongwana has warned that South Africa’s debt has risen too fast and too high – currently R5.2 trillion, and the country has to manage its debt more effectively.

Godongwana made the remarks on Wednesday while delivering his Medium-Term Budget Policy Statement (MTBPS) In Parliament.

“We are anticipating that government debt will reach more than R6.05 trillion, or 75.5% of GDP, in 2025/26,” he said.

“We know that our debt is unsustainable, because debt-service costs have become the largest component of our spending and it is rising faster than economic growth.”

Godongwana said debt-service costs would reach R388.9 billion in the current financial year.

He explained that effectively this means for every one rand of revenue that government raises this year, 22 cents of this is paid in debt-service costs.

“To deal with this problem, we have taken difficult steps to reduce the budget deficit. We have restrained spending and maintained stable tax collection,” Godongwana said.

Godongwana said that as a result of government’s measures, they have achieved a primary budget surplus in 2023/24, for the first time in 15 years and this surplus is needed to help stabilise debt.

“The primary surplus is not a pot of money. Rather, it is the difference between what government spends, excluding debt-service costs and what government collects in revenue,” he added.

The minister estimated the country’s Gross Domestic Product (GDP) growth was 1.1% in 2024.

He said that the growth was lower than the estimate of 1.3% forecast in February.

Over the medium term, the main budget deficit will decline from 4.7% of GDP in 2024/25 to 3.4% in 2027/28, with the primary budget surplus rising to 1.8%of GDP, Godongwana said.

“This underscores the need for higher inclusive growth to meet the aspiration of a better life for all. This policy statement outlines our strategy to lift the economy to a higher and more inclusive growth path,” the minister said.